St. Louis Blues sign Patrick Maroon …

Cap Friendly: After the Blues signed forward Patrick Maroon to a one-year, $1.75 million deal, they now have about $3.284 million in cap space with 23 players signed – 15 forwards, six defense, and two goaltenders.

They have three remaining restricted free agents – Jordan Schmaltz, Petteri Lindbolm, and Joel Edmundson (arbitration date is set).

Coyotes missed out on Maroon …

Craig Morgan: A source was saying that the Arizona Coyotes had interest in signing Maroon before he signed with the Blues.

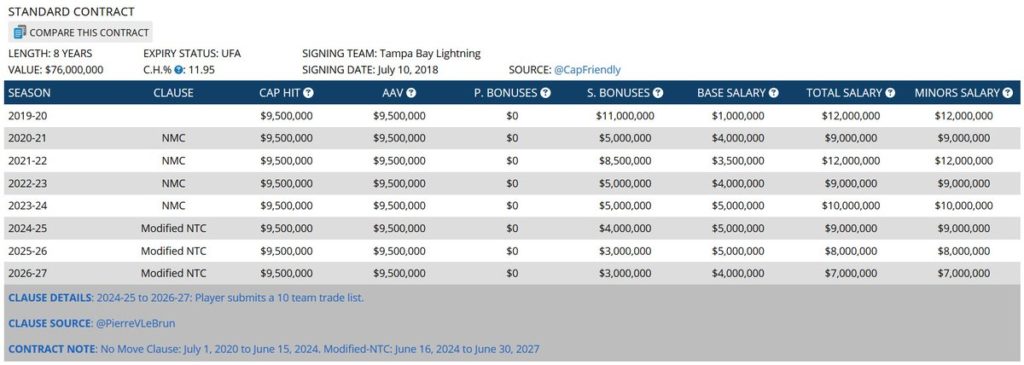

More details on Nikita Kucherov‘s contract …

Cap Friendly: Breakdown of Kucherov no-movement and no-trade clauses.

- Full No Move Clause: Jul 1, 2020 to Jun 15, 2024

- Modified No Trade Clause: Jun 16, 2024 to Jun 30, 2027 – 10 team trade list

Breaking down some NHL player tax info …

Collection of tweets from Clark Aitken on how NHL players pay taxes.

Clark Aitken: “Hi! Guy who’s done tax returns for professional hockey players here. A pro athlete does not pay taxes in the same way that you, a person working a job in the same city every single day, does.

Hockey players pay taxes based on whatever jurisdiction they are in for that proportion of their salary. So, if you go on a quick road trip to play the Rangers and Islanders, you pay tax on the equivalent of 2-3 days of your salary in the state of NY.

A pro hockey players; tax return ends up including A TON of payments owed to individual states and cities. When they play in Canada, they get taxes at provincial rates on a similar proportion.

What that means in practice is that the tax advantages are somewhat mitigated by everybody paying reasonably similar blended tax rates on the 41 road games they play a season.

Somebody asked me about how signing bonuses impact that, and it’s a good question that I don’t know the answer to as signing bonuses weren’t weaponized like they are know when I was in public accounting.

It does feel like an implicit advantage to no-tax locations, and it’s probably one of three reasons why Bettman is imploring teams not to sign such bonus-laden contracts.

The other reasons being that signing bonuses f*** up escrow calculations, making it harder for the PA to get what it wants on that front, and also giving teams guaranteed money weakens your position going into a lockout.

Giving players guaranteed money, not teams. Way to stick that landing…”